SECURITIES AND EXCHANGE COMMISSION

Proxy Statement Pursuant to Section 14 (a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒x

Filed by a Party other than the Registrant ☐¨

Check the appropriate box:

¨Preliminary Proxy Statement ¨ CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS

PERMITTED BY RULE 14A-6(E)(2))

x Definitive Proxy Statement

¨ Definitive Additional Materials

¨Soliciting Material Pursuant to (S) 240.14a-11(c) or (S) 240.14a-12

| | |

☐ Preliminary Proxy Statement | | ☐ CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14A-6(E)(2)) |

☒ Definitive Proxy Statement |

☐ Definitive Additional Materials | | |

☐ Soliciting Material Pursuant to (S)240.14a-11(c) or (S)240.14a-12 |

(Name of Registrant as Specified In Its Charter)

(Name of Person (s)Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

xNo fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6 (i) (4) and 0-11.

(1) Title of each class of securities to which transactions applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transactions computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

¨ Fee paid previously with preliminary materials.

¨Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6 (i) (4) and 0-11. |

| (1) | Title of each class of securities to which transactions applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transactions computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

Notes:

PROXY STATEMENT

AND NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

2019

Tuesday, April 16, 2019 at 8:00 a.m. CDT

325 North LaSalle

Chicago, Illinois

| | |

|

| WHIRLPOOL CORPORATION Benton Harbor, Michigan 49022-2692 |

ToDear Fellow Shareholder:

First and foremost, we would like to express our sincere appreciation for your continued support as a Whirlpool shareholder. Whirlpool is committed to operating sustainably and to creating shareholder value over the long-term, and we have a high functioning Board and sound corporate governance structure in place to oversee this commitment. We are proud to tell our corporate governance story in the following pages, which includes these highlights.

Strategic Objectives

During 2019, Whirlpool accomplished a number of significant strategic objectives. We completed the divestiture of our Embraco compressor business, took decisive actions to return our EMEA business to profitability in the fourth quarter, and made significant progress in meeting our long-term gross debt-to-EBITDA goal. Our Stockholders:

Board is deeply involved in developing and overseeing our strategy, and played a critical role in ensuring the success of these strategic objectives in 2019.Board Refreshment and Diversity

Whirlpool is committed to a Board composition that reflects an effective mix of business expertise, company knowledge, and diverse perspectives, and our goal is to strike the right balance between board refreshment and continuity. Last year, we appointed Patricia K. Poppe, who is President and Chief Executive Officer of CMS Energy Corporation, to our Board of Directors. She brings extensive leadership experience in consumer-facing industries and environmental stewardship to our Board. We are also pleased to nominate to our Board Jennifer A. LaClair, who is Chief Financial Officer of Ally Financial Inc. She will bring significant finance, accounting and capital markets expertise to our Board. With these additions, we will have added five new directors to our Board in the past four years.

Sustainability and Corporate Responsibility

Our Board is committed to overseeing Whirlpool Corporation’s integration of environmental, social, and governance principles throughout Whirlpool. In December 2019, we became a signatory to the UN Global Compact. In 2019, we set new science-based targets for GHG emissions reductions, celebrated our 20th year of collaboration withHabitat for Humanity, continued to collaborate with theUnited Way to fund hundreds of non-profit campaigns for our communities, and sponsored our first-ever Global Inclusion Week with events for employees at company offices around the world.

Shareholder Engagement

Whirlpool values the feedback of our shareholders and seeks opportunities to engage on company performance, strategy, and governance, among other topics. In May 2019, we held an Investor Day at the New York Stock Exchange where senior leadership presented on our long-term shareholder value creation goals and key strategic initiatives.

It is myour pleasure to invite you to attend the 20192020 Whirlpool Corporation annual meeting of stockholders to be held on Tuesday, April 16, 2019,21, 2020, at 8:00 a.m., Chicago time, at 325331 North LaSalle, Chicago, Illinois.

At the meeting, stockholders will vote on the matters set forth in the formal notice of the meeting that follows on the next page. In addition, we will discuss Whirlpool's 2018our 2019 performance and theour outlook for this year, and we will answer your questions.

We have included with this booklet an annual report containing important financial and other information about Whirlpool.

We are pleased to once again furnish proxy materials to our stockholders via the Internet. We believe this approach provides our stockholders with the information they need, while lowering the costs of delivery and reducing the environmental impact of our annual meeting.

Your vote is important. We urge you to please vote your shares now whether or not you plan to attend the meeting. You may revoke your proxy at any time prior to the proxy being voted by following the procedures described in this booklet.

Your vote is important and much appreciated!

MARC R. BITZER

Chairman of the Board

and Chief Executive Officer

March 1, 2019

NOTICE OF 2019 ANNUAL MEETING OF STOCKHOLDERS

|

| | | | | |

| | | |

MARC R. BITZER Chairman of the Board and Chief Executive Officer | |  | | |

SAMUEL R. ALLEN Presiding Director | | | |  |

March 6, 2020

NOTICE OF 2020 ANNUAL MEETING OF STOCKHOLDERS

The 20192020 annual meeting of stockholders ofWHIRLPOOL CORPORATION will be held at 325 North LaSalle, Chicago, Illinois, on Tuesday, April 16, 2019,21, 2020, at 8:00 a.m., Chicago time, at 331 North LaSalle, Chicago, Illinois, for the following purposes:

| |

| 1. | To elect 13 persons to Whirlpool'sthe Whirlpool Corporation Board of Directors; |

| |

| 2. | To approve, on an advisory basis, Whirlpool'sWhirlpool Corporation’s executive compensation; |

| |

| 3. | To ratify the appointment of Ernst & Young LLP as Whirlpool'sWhirlpool Corporation’s independent registered public accounting firm for 2019;fiscal 2020; and |

| |

| 4. | To transact such other business as may properly come before the meeting. |

A list of stockholders entitled to vote at the meeting will be available for examination by any stockholder for any purpose relevant to the meeting during ordinary business hours for at least ten days prior to April 16, 2019,21, 2020, at Whirlpool'sWhirlpool Corporation’s Global Headquarters, 2000 NorthM-63, Benton Harbor, Michigan 49022-2692.

49022-2692 and also during the annual meeting.By Order of the Board of Directors,

BRIDGET K. QUINN

Assistant General Counsel and Corporate Secretary

March 1, 20196, 2020

Important Notice Regarding the Availability of Proxy Materials for

the Annual Meeting of Stockholders to be Held on April 21, 2020

This Proxy Statement and the Accompanying Annual Report are Available at:

https://investors.whirlpoolcorp.com/financial-information/annual-reports-and-proxy-statements/

This summary highlights information contained elsewhere in the proxy statement. This summary provides an overview and is not intended to contain all the information that you should consider before voting. We encourage you to read the entire proxy statement for more detailed information on each topic prior to casting your vote.

GENERAL INFORMATION

General Information

|

| | |

| Meeting: Annual Meeting of Stockholders

| |

| Date: Tuesday, April 16, 2019

| |

| Time: 8:00 a.m., Chicago time

| |

| Location: 325 N. LaSalle, Chicago, Illinois

| |

| Record Date: February 19, 2019

| |

| Stock Symbol: WHR

| |

| Exchange: NYSE & CHX

| |

| Common Stock Outstanding as

of the Record Date: 63,621,219 shares

| |

| Registrar & Transfer Agent: Computershare Trust Company, N.A.

| |

| Corporate Website:www.whirlpoolcorp.com

| |

2018 COMPANY PERFORMANCE HIGHLIGHTS *

GAAP net earnings per share were $(2.72) and ongoing (non-GAAP) earnings per share were a record $15.16 in 2018, as we overcame 200 bps in significant cost and currency challenges. We reported cash provided by operating activities of $1.2 billion and free cash flow of $853 million for full-year 2018, with free cash flow improving compared to prior year. And we returned a record $1.5 billion in cash to stockholders.

|

| | | | |

| | |

| | uMeeting:Annual Meeting of Stockholders uDate: Tuesday, April 21, 2020 uTime: 8:00 a.m., Chicago time uLocation: 331 N. LaSalle, Chicago, Illinois uRecord ongoingDate: February 24, 2020 uStock Symbol: WHR uExchange: NYSE & CHX uCommon Stock Outstanding as of the Record Date: 62,677,753 shares uRegistrar & Transfer Agent:Computershare Trust Company, N.A. uCorporate Website: www.whirlpoolcorp.com | | |

2019 Company Performance Highlights *

In 2019, Whirlpool delivered record full-year GAAP earnings per share of $18.45, and ongoing (non-GAAP) earnings per share of $16.00. Our GAAP net earnings margin expanded 6.7 points to 5.8% and our ongoing EBIT margin expanded by 60 basis points to 6.9%. We generated $1.2 billion of cash from operating activities, flat compared to prior year, and $912 million of free cash flow, a 6.9% improvement compared to 2018. We also closed the sale of our Embraco compressor business and made significant progress towards our long-term gross debt/EBITDA target of 2x.

| | | | | | | | |

| | | | |

Record earnings per share of $15.16 $18.45 (GAAP) and $16.00 (Ongoing) | | Free cash flow of $853 million, an improvement compared to prior year | | Returned $1.5 billion inFree cash to stockholders flow of $912 million | | | | Significant progress toward long-term Gross Debt/ EBITDA target of 2x |

*See page 24 for details of the Company's results for the 2018| * | See page 20 for details of the Company’s results for the 2019 fiscal year. Please also see Annex A for a reconciliation of non-GAAP financial measures.

non-GAAP financial measures. |

The proxy statement and annual report are available atwww.proxyvote.com.

| | | | |

| Notice of Annual Meeting of Stockholders and 2020 Proxy Statement | |  ç ç | | i |

OVERVIEW OF VOTING MATTERS

| | | | |

| | |

Board recommendation | | PROXY SUMMARY | | |

Overview of Voting Matters

| | |

| |

| | Board

recommendation |

| |

Item 1: Election of Directors (page: 6) | FOR each nominee

|

| 1) You are being asked to vote on the election of 13 Directors. The Corporate Governance and Nominating Committee believes that these nominees possess the experience and qualifications to provide sound guidance and oversight to the Company's management. Directors are elected by majority vote for a term of one year. | | FOR

each nominee |

| |

Item 2: Advisory Vote to Approve Whirlpool Corporation’s Executive Compensation (page: 63) | FOR |

| 50) You are being asked to approve, on an advisory basis, the compensation of the Company'sWhirlpool Corporation’s Named Executive Officers for 2018.2019. | | FOR |

| |

Item 3: Ratification of the Appointment of Ernst & Young LLP as Whirlpool Corporation’s Independent Registered Public Accounting Firm for fiscal 2020 (page: 68) | FOR |

54)You are being asked to ratify the Audit Committee'sCommittee’s appointment of Ernst & Young LLP as Whirlpool's Whirlpool Corporation’s Independent Registered Public Accounting Firm for 2019. fiscal 2020. | | FOR |

CORPORATE GOVERNANCE HIGHLIGHTS

Corporate Governance Highlights

For more information about the Company'sCompany’s corporate governance policies, please refer to the Board of Directors and Corporate Governance section beginning on page 116 of the proxy statement.

| | | | |

| | |

• | | uProxy Access |

• | uMajority Voting in Director Elections |

• | uBoard Refreshment (Three(Will Yield Five New Independent Directors in Threeover the Past Four Years) |

• | uAnnual Director Elections |

• | uIndependent Presiding Director u Shareholder Engagement u Our Integrity Manual (Global Code of Ethics) | | |

| | | | |

•ii | Global Code | ç | | Notice of EthicsAnnual Meeting of Stockholders and 2020 Proxy Statement |

DIRECTOR NOMINEES

Director Nominees

Additional details about each of the director nominees can be found beginning on page 6.

|

| | | | | | | | | | | | | |

Name * indicates Independent Director | Samuel

Allen * | Marc Bitzer | Greg Creed * | Gary

DiCamillo * | Diane

Dietz * | Gerri Elliott * | Michael Johnston * | John

Liu * | James Loree * | Harish Manwani * | William

Perez * | Larry Spencer * | Michael

White * |

| Age | 65 | 54 | 61 | 68 | 53 | 62 | 71 | 50 | 60 | 65 | 71 | 65 | 67 |

| Director since | 2010 | 2015 | 2017 | 1997 | 2013 | 2014 | 2003 | 2010 | 2017 | 2011 | 2009 | 2016 | 2004 |

| Committee Membership (# of meetings in 2018) |

| Audit Committee (8) | | | | X | | X | X | X | X | | | | Chair |

| Human Resources Committee (5) | X | | X | | X | | Chair | | | X | X | | |

| Finance Committee (2) | | | X | X | | X | | X | | | Chair | X | |

| CG&N Committee (3) | Chair | | | | X | | | | X | X | | X | X |

TENURE, EXPERIENCE, AND DIVERSITY

1. | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | Committee Membership |

| | | | | | | | |

Name | | Age | | Director

since | | Independent | | Audit | | Human

Resources | | Finance | | Corporate

Governance

&

Nominating |

| | | | | | | | |

Samuel Allen | | 66 | | 2010 | | * | | | | ✓ | | | | ✓ |

| | | | | | | | |

Marc Bitzer | | 55 | | 2015 | | | | | | | | | | |

| | | | | | | | |

Greg Creed | | 62 | | 2017 | | * | | | | ✓ | | ✓ | | |

| | | | | | | | |

Gary DiCamillo | | 69 | | 1997 | | * | | ✓ | | | | ✓ | | |

| | | | | | | | |

Diane Dietz | | 54 | | 2013 | | * | | | | ✓ | | | | ✓ |

| | | | | | | | |

Gerri Elliott | | 63 | | 2014 | | * | | ✓ | | | | ✓ | | |

| | | | | | | | |

Jennifer LaClair | | 48 | | — | | * | | | | | | | | |

| | | | | | | | |

John Liu | | 51 | | 2010 | | * | | ✓ | | | | ✓ | | |

| | | | | | | | |

James Loree | | 61 | | 2017 | | * | | ✓ | | | | | | ✓ |

| | | | | | | | |

Harish Manwani | | 66 | | 2011 | | * | | | | ✓ | | | | ✓ |

| | | | | | | | |

Patricia Poppe | | 51 | | 2019 | | * | | ✓ | | | | | | ✓ |

| | | | | | | | |

Larry Spencer | | 66 | | 2016 | | * | | | | | | ✓ | | ✓ |

| | | | | | | | |

Michael White | | 68 | | 2004 | | * | | ✓ | | | | | | ✓ |

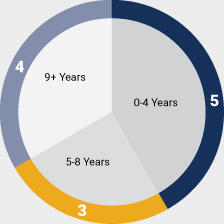

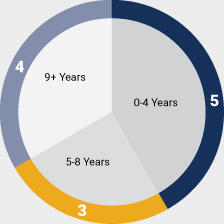

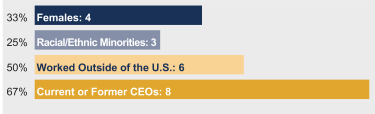

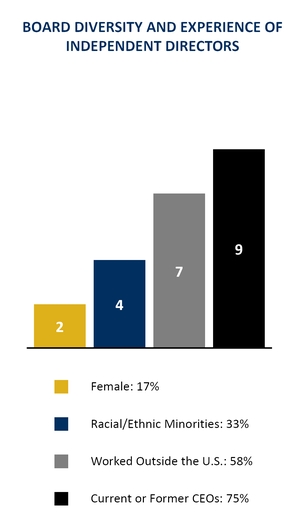

Tenure, Experience, and Diversity

Our Board of Directors reflects an effective mix of business expertise,

company knowledge, and diverse perspectives.

| | |

Board Tenure of Independent Director Nominees

| | Board Diversity and Experience of Independent Director Nominees

|

|

| | | |

| | |

| | | PROXY SUMMARY | | |

COMPENSATION HIGHLIGHTS |

Compensation Highlights

The Compensation Discussion & Analysis (CD&A)(“CD&A”) section beginning on page 2420 includes the following highlights:

|

| |

What we do: | What we don't do: |

ü Pay for performance

| X Allow hedging or pledging

|

ü Robust executive stock ownership guidelines

| X Gross up for excise taxes

|

ü “Double trigger” change in control

| X Reprice stock options

|

ü Claw-back policies for all variable pay

| X Grant RSUs that pay dividends/equivalents

prior to vesting

|

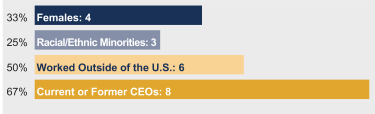

OUR COMPENSATION PHILOSOPHY: PAY FOR PERFORMANCE

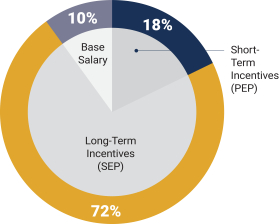

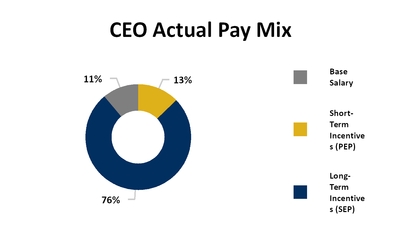

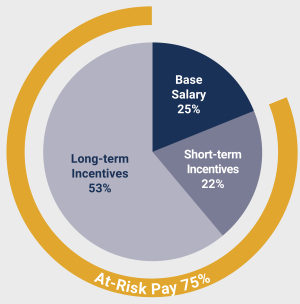

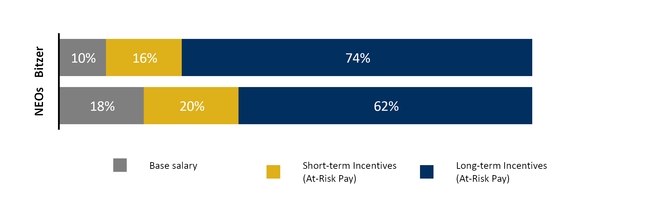

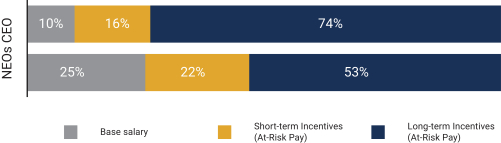

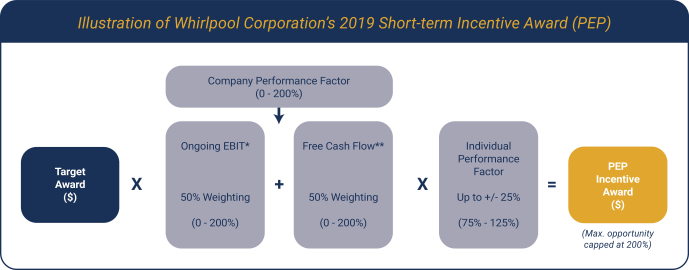

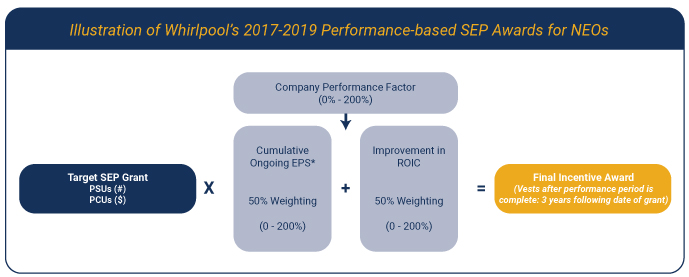

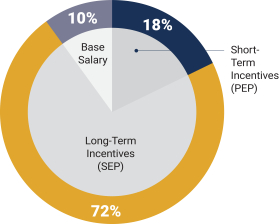

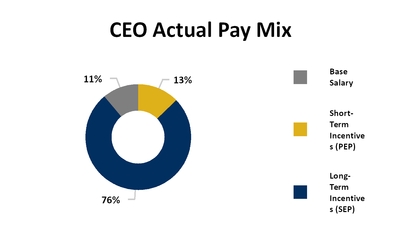

The Company employs a pay-for-performance philosophy which provides that compensation should be incentive-driven, a significant portion of pay should be performance-based, compensation should be linked to the drivers of long-term stockholder value, and compensation should be tied to business results and individual performance. The majority of 2018 CEO and NEO target compensation consisted of at-risk pay, as demonstrated in the table below.

2018 EXECUTIVE COMPENSATION SUMMARY

|

| | | | | |

| Named Executive Officer | 2018 Base Salary ($) | 2018 Short-Term Incentive Award ($) | 2018 Long-Term Incentive Award Value(1) ($) | 2018 TOTAL DIRECT COMPENSATION (2) ($) |

| Marc R. Bitzer | 1,250,000 | 1,462,500 | 8,749,813 |

| 11,462,313 |

| James W. Peters | 641,667 | 446,405 | 1,700,694 |

| 2,788,766 |

Jeff M. Fettig | 1,050,000 | 1,146,600 | 6,299,851 |

| 8,496,451 |

| Joseph T. Liotine | 641,667 | 625,625 | 1,455,855 |

| 2,723,147 |

| João C. Brega | 589,295 | 463,042 | 756,149 |

| 1,808,486 |

| |

1. | Long-Term Incentive Award Value column includes total grant date fair value of Stock Awards and Option Awards. For Messrs. Peters, Liotine and Brega, this column also includes performance cash units earned during the 2016-2018 performance period. |

| |

2. | Total Direct Compensation does not include items that are included in the "All Other Compensation" category as disclosed in the Summary Compensation Table on page 43, nor does it include changes in pension benefits. Pension accruals are determined by formula and do not involve a Board or Human Resources Committee decision. Please see the Summary Compensation Table on page 43 for full details. |

|

| | | | |

92% stockholder support for "Say On Pay" resolution at our 2018 Annual Meeting |

TABLE OF CONTENTS

|

| | | | | | |

| | | |

| What We Do | | What We Don’t Do | |

|

| | | | |

| ✓ | | Pay for performance | |

| | Allow hedging or pledging | | |

| | PROXY STATEMENT | | | |

| ✓ | | Robust executive stock ownership guidelines | |

| | Gross up for excise taxes | | |

| | Important Notice Regarding the Availability of Proxy Materials

for the Annual Meeting of Stockholders to be Held on April 16, 2019:

This Proxy Statement and the Accompanying Annual Report are Available at:https://investors.whirlpoolcorp.com/financial-information/annual-reports-and-proxy-statements/

| | | |

| ✓ | | “Double trigger” change in control | |

| | Reprice stock options | | |

| | | | | |

| ✓ | | Claw-back policies for all variable pay | |

| | Enter into employment contracts withU.S.-based NEOs | | |

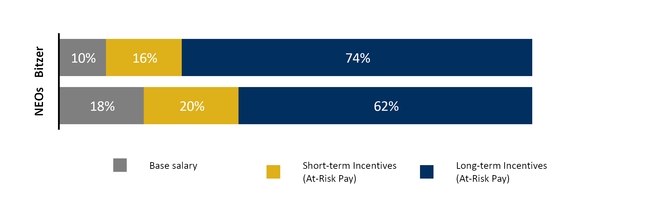

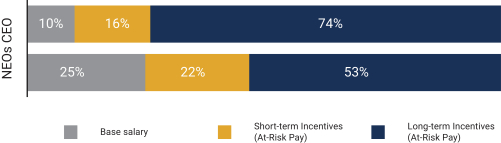

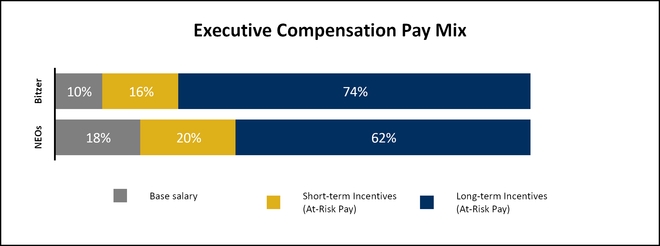

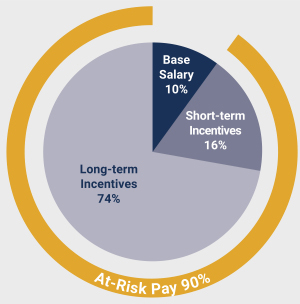

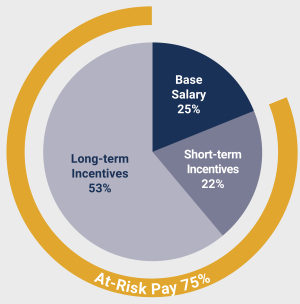

Information aboutOur Compensation Philosophy: Pay for Performance

Whirlpool employs a pay-for-performance philosophy under which a significant portion of pay is performance-based and tied to the Annual Meetingdrivers of long-term stockholder value, including both business results and Voting

Ourindividual performance. The majority of 2019 annual meetingCEO and NEO target compensation consisted of stockholders will be held on Tuesday, April 16, 2019, at 8:00 a.m., Chicago time, at 325 North LaSalle, Chicago, Illinois. This proxy statement contains information about the matters being submitted to a vote of the stockholders. It also gives you information that we are required to provide under U.S. Securities and Exchange Commission rules and which is intended to help you make informed voting decisions.

Why am I receiving these materials?

You received these proxy materials because our Board of Directors (the "Board") is soliciting your proxy to vote your shares at our annual meeting of stockholders. By giving your proxy, you authorize persons selected by the Board to vote your shares at the annual meetingat-risk pay, as demonstrated in the

way that you instruct. All shares represented by valid proxies received before the annual meeting will be voted in accordance with the stockholder's specific voting instructions.illustration below.Executive Compensation Pay Mix

| | |

CEO Total Target Compensation | | Other NEOs’ Average Total Target Compensation |

| |

| |

|

Why did I receive a Notice Regarding the Availability of Proxy Materials?

As permitted by Securities and Exchange Commission rules, we are making this proxy statement and our annual report (the "Proxy Materials") available to our stockholders electronically via the Internet. On or about March 6, 2019, we intend to mail to our stockholders a notice containing instructions on how to access the Proxy Materials and how to vote their shares online. If you receive a Notice Regarding the Availability of Proxy Materials (a "Notice") by mail, you will not receive a printed copy of the Proxy Materials in the mail unless you specifically request them. Instead, the Notice instructs you on how to review the Proxy Materials and submit your voting instructions over the Internet. If you receive a Notice by mail and would like to receive a printed copy of our Proxy Materials, you should follow the instructions contained in the Notice for requesting such materials.

What is "householding" and how does it affect me?

The Securities and Exchange Commission's rules permit us to deliver a single Notice or set of Proxy Materials to one address shared by two or more of our stockholders. This delivery method is referred to as "householding" and can result in significant cost savings. To take advantage of this opportunity, we have delivered only one Notice or set of Proxy Materials to multiple stockholders who share an address, unless we received contrary instructions prior to the mailing date. If you prefer to receive separate copies of the Notice or Proxy Materials, contact Broadridge Investor Communication Solutions, Inc. at (866) 540-7095 or in writing at Broadridge, Householding Department, 51 Mercedes Way, Edgewood, NY, 11717, and we will deliver a separate copy promptly. If you are currently a stockholder sharing an address with another stockholder and wish to receive only one copy of future Notices or Proxy Materials for your household, please contact Broadridge at the above phone number or address.

| | | | |

| iv | | ç | | Notice of Annual Meeting of Stockholders and 2020 Proxy Statement |

Notice of Annual Meeting of Stockholders and 2019 Proxy Statement l 1

What does it mean if I receive more than one Notice, proxy card or instruction form?

This means that your shares are registered differently and are held in more than one account. To ensure that all shares are voted, please vote each account over the Internet or by telephone, or sign and return by mail all proxy cards and instruction forms. We encourage you to have all your accounts registered in the same name and address by contacting our transfer agent, Computershare Trust Company, N.A., Shareholder Services, at (877) 453-1504; TDD/TTY for hearing impaired: (800) 952-9245 or in writing at P.O. Box 505000, Louisville, KY, 40233-5000. If you hold your shares through a bank or broker, you can contact your bank or broker to request consolidation.

Who can vote on matters presented at the annual meeting?

Stockholders of record of Whirlpool common stock as of the record date, February 19, 2019, are entitled to vote on matters presented at the annual meeting. Each of the approximately 63,621,219 shares of Whirlpool common stock issued and outstanding as of that date is entitled to one vote.

What is the difference between holding stock as a stockholder of record and as a beneficial owner?

If your shares are registered in your name with Whirlpool's transfer agent, Computershare Trust Company, N.A., you are the "stockholder of record" of those shares. If your shares are held in a stock brokerage account, bank or other holder of record, you are considered the "beneficial owner" of those shares. As the beneficial owner, you have the right to direct your broker, bank or other holder of record how to vote your shares by using the voting instruction card or by following their instructions for voting by telephone or on the Internet.

How do I vote my shares?

You may attend the annual meeting and vote your shares in person if you are a record holder. If you are a beneficial owner, you may obtain a legal proxy from your broker, bank, or other holder of record, attend the annual meeting, and vote your shares in person. You may vote without attending the annual meetingby granting a proxy for shares of which you are the stockholder of record, or by submitting voting instructions to your broker or nominee for shares that you hold beneficially in street name. In most cases, you will be able to do this by Internet or telephone, or by mail if you received a printed set of Proxy Materials.

By Internet - If you have Internet access, you may submit your proxy by following the instructions provided in the Notice, or if you received a printed set of Proxy Materials by mail, by following the instructions provided with your Proxy Materials and on your proxy card or voting instruction card.

By Telephone -If you have Internet access, you may obtain instructions on voting by telephone by following the Internet access instructions provided in the Notice. If you received a printed set of Proxy Materials, your proxy card or voting instruction card will provide instructions to vote by telephone.

By Mail - If you received a printed set of Proxy Materials, you may submit your proxy by mail by signing your proxy card if your shares are registered in your name or by following the voting instructions provided by your broker, nominee or trustee for shares held beneficially in street name, and mailing it in the enclosed envelope.

A Notice cannot be used to vote your shares. The Notice does, however, provide instructions on how to vote by Internet, or by requesting and returning a paper proxy card or voting instruction card.

2lNotice of Annual Meeting of Stockholders and 2019 Proxy Statement

What if I submit my proxy or voting instructions, but do not specify how I want my shares to be voted?

If you are a stockholder of record and you do not specify how you want to vote your shares on your signed proxy card or by Internet or telephone, then the proxy holders will vote your shares in the manner recommended by the Board for all matters presented in this proxy statement and as they determine in their discretion with respect to other matters presented for a vote at the annual meeting. If you are a beneficial owner and you do not give specific voting instructions, the institution that holds your shares may generally vote your shares on routine matters, but may not vote your shares on non-routine matters. If you do not give specific voting instructions to the institution that holds your shares with respect to a non-routine matter, the institution will inform the inspector of election that it does not have authority to vote on this matter with respect to your shares. This is called a broker non-vote. The only routine matter included in this proxy statement is the ratification of the appointment of Ernst & Young LLP as Whirlpool's independent registered public accounting firm for 2019.

What if other business comes up at the annual meeting?

If any nominee named herein for election as a director is not available to serve, the accompanying proxy will be voted in favor of the remainder of those nominated and may be voted for a substitute nominee. Whirlpool expects all nominees to be available to serve and knows of no matter to be brought before the annual meeting other than those covered in this proxy statement. If, however, any other matter properly comes before the annual meeting, we intend that the accompanying proxy will be voted thereon in accordance with the judgment of the persons voting such proxy.

What if I want to revoke my proxy or change my vote?

If you are a stockholder of record, you may revoke your proxy at any time before it is exercised in any of three ways: (1) by submitting written notice of revocation to Whirlpool's Corporate Secretary; (2) by submitting another proxy via the Internet, telephone, or mail that is dated as of a later date and properly signed; or (3) by voting in person at the meeting. You may change your vote by submitting another timely vote by Internet, telephone or mail, or voting in person at the annual meeting. If you are a beneficial owner, you must contact the institution that holds your shares to revoke your voting instructions or change your vote.

What if I hold shares through the Whirlpool 401(k) Retirement Plan?

If you participate in the Whirlpool 401(k) Retirement Plan and hold shares of Whirlpool stock in your plan account as of the record date, you will receive a request for voting instructions from the plan trustee (Vanguard) with respect to your plan shares. If you hold Whirlpool shares outside of the plan, you will vote those shares separately. You are entitled to direct Vanguard how to vote your plan shares. If you do not provide voting instructions to Vanguard by 11:59 p.m. Eastern time on April 11, 2019, the Whirlpool shares in your plan account will be voted by Vanguard in the same proportion as the shares held by Vanguard for which voting instructions have been received from other participants in the plan. You may revoke your previously provided voting instructions by submitting either a written notice of revocation or a properly executed proxy dated as of a later date prior to the deadline for voting plan shares.

What should I know about attending the annual meeting?

If you attend, please note that you will be asked to check in at the registration desk and present valid photo identification. If you are a beneficial owner, you will also need to bring a copy of your voting instruction card or brokerage statement reflecting your stock ownership as of the record date. If you wish to designate someone as a proxy to attend the annual meeting on your behalf, that person must bring a valid legal proxy containing your signature and printed or typewritten name as it appears in the list of registered stockholders or on your account statement if you are a beneficial owner. Cameras, recording devices, cell phones, and other electronic devices will not be permitted at the meeting other than those operated by Whirlpool or its designees. All bags, briefcases, and packages will need to be checked at the door or will be subject to search.

Notice of Annual Meeting of Stockholders and 2019 Proxy Statement l 3

Who will count the votes?

Broadridge Investor Communication Solutions, Inc. will act as the independent inspector of election and will certify the voting results.

Will my vote be confidential?

Whirlpool's Board has adopted a policy requiring all votes to be kept confidential from management except when disclosure is made public by the stockholder, required by law, and/or in other limited circumstances.

What is the quorum for the annual meeting?

Stockholders representing at least 50% of the common stock issued and outstanding as of the record date must be present at the annual meeting, either in person or represented by proxy, for there to be a quorum at the annual meeting. Abstentions and broker non-votes are counted as present for establishing a quorum.

How many votes are needed to approve the proposals?

Item 1 (Election of Directors). For the election of directors (provided the number of nominees does not exceed the number of directors to be elected), each director nominee must receive the majority of the votes cast with respect to that director nominee (number of votes cast "for" a director nominee must exceed the number of votes cast "against" that director nominee).

Item 2 (Advisory Vote to Approve Whirlpool's Executive Compensation). The affirmative vote of a majority of the outstanding common stock present in person or represented by proxy at the annual meeting and entitled to vote is required to approve Whirlpool's named executive officer compensation.

Item 3 (Ratification of Ernst & Young LLP). The affirmative vote of a majority of the outstanding common stock present in person or represented by proxy at the annual meeting and entitled to vote is required to approve the ratification of Ernst & Young LLP as Whirlpool's independent registered public accounting firm.

Other Business. The affirmative vote of a majority of the outstanding common stock present in person or represented by proxy at the annual meeting and entitled to vote is required to approve any other matter that may properly come before the meeting.

How are abstentions and broker non-votes treated?

Abstentions will have no effect on Item 1. Abstentions will be treated as being present and entitled to vote on Items 2 and 3, and therefore, will have the effect of votes against such proposals. If you do not provide your broker or other nominee with instructions on how to vote your shares held in street name, your broker or nominee will not be permitted to vote them on non-routine matters, such as Items 1 and 2, which will result in a broker non-vote. Shares subject to a broker non-vote will not be considered entitled to vote with respect to Items 1 and 2, and will not affect the outcome on those Items. We encourage you to provide instructions to your broker regarding how to vote your shares.

Who will pay for this proxy solicitation?

Whirlpool will pay the expenses of the solicitation of proxies. We expect to pay fees of approximately $14,500 plus certain expenses for assistance by D.F. King & Co., Inc. in the solicitation of proxies. Proxies may be solicited by directors, officers, Whirlpool employees, and by D.F. King & Co., Inc. , personally and by mail, telephone or other electronic means.

4lNotice of Annual Meeting of Stockholders and 2019 Proxy Statement

How do I submit a stockholder proposal for the 2020 annual meeting?

Our annual meeting of stockholders is generally held on the third Tuesday in April. Any stockholder proposal that you intend to have us include in our proxy statement for the annual meeting of stockholders in 2020 must be received by the Corporate Secretary of Whirlpool at corporate_secretary@whirlpool.com by November 7, 2019, and must otherwise comply with the Securities and Exchange Commission's rules in order to be eligible for inclusion in the proxy statement and proxy form relating to this meeting. Other proposals must be received by the Corporate Secretary of Whirlpool personally, by registered or certified mail by January 22, 2020, and must satisfy the procedures set forth in Whirlpool's by-laws to be considered at the 2020 annual meeting.

Stockholders may also, under certain circumstances, nominate directors for inclusion in our proxy materials by complying with the requirements in our by-laws. For more information regarding proxy access, please see the next question.

How do I nominate a director using proxy access?

In 2016, our Board adopted a "proxy access" by-law after thoughtful consideration of the appropriate proxy access structure for the Company and engagement with our stockholders. The proxy access by-law allows a stockholder, or a group of up to 20 stockholders, who have held 3% or more of our outstanding shares continuously for at least three years to nominate and include in the Company's proxy materials director nominees constituting up to the greater of two individuals or 20% of our Board, provided that the stockholder(s) and nominee(s) satisfy the requirements specified in Article II, Section 13 of our by-laws.

To be included in the proxy materials for our 2020 annual meeting of stockholders, we must receive a stockholder's notice to nominate a director under our proxy access by-law between October 8, 2019 and November 7, 2019. Such notice must be delivered to, or mailed to and received by, the Corporate Secretary of Whirlpool. The notice must contain the information required by our by-laws, and the stockholder(s) and nominee(s) must comply with the information and other requirements in our by-laws relating to the inclusion of stockholder nominees in our proxy materials.

Notice of Annual Meeting of Stockholders and 2019 Proxy Statement l 5

| | | | |

| | |

| | Item 1- Election of Directors ITEM 1 - ELECTION OF DIRECTORS |

| | Director Nominees |

ItemITEM 1 – DirectorsDIRECTORS AND NOMINEES

FOR ELECTION AS DIRECTORS

Whirlpool is committed to delivering significant, long-term value to our consumers and Nominees for Election as Directors

As the number one major appliance manufacturer in the world, based upon most recently available publicly-reported annual revenue among leading appliance manufacturers, with revenues of approximately $21 billionour stockholders, and sales in nearly every country around the world, we believe our Board should be composed of individuals with experience and demonstrated expertise in many substantive areas that impact our business and align with the Company'sour strategy. We believe our directors and nominees possess the professional and personal qualifications necessary for service on our Board. We have highlighted below the specific qualifications of our directors and nominees in relation to our strategy.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | |

Global Strategic Imperatives | |  | | Deliver Product Leadership | | | | |  | | | Redefine What Product is | | | | |  | | | Win the Digital Consumer Journey | | | | |  | | | Reinvent Our Value Chain | | |

| | |

| |

Skills and Experience | | Relevance to Whirlpool'sOur Strategy |

Leadership of Large/

Complex Organizations

| • | •Whirlpool is a large, complex, global company, and directors who have successfully held leadership positions in such organizations possess experience and the ability to drive strong results. |

Directors with expertise: | | Allen, Bitzer, Creed, DiCamillo, Dietz, Elliott, Johnston, LaClair, Loree, Manwani, Perez, Poppe, Spencer, White |

Global Business Operations

| • | Whirlpool's• Our continued profitable growth depends on strong operational execution in emerging markets and other countries beyond the United States, and global experience aids directors in oversight of our global business and strategy. |

Directors with expertise: | | Allen, Bitzer, Creed, DiCamillo, Dietz, Elliott, Johnston, Liu, Loree, Manwani, Perez, Poppe, Spencer, White |

International Work Experience

| • | •Whirlpool sells products in nearly every country throughout the world, and directors with international experience possess unique perspectives on the countries in which we operate. |

Directors with expertise: | | Allen, Bitzer, Creed, DiCamillo, Dietz, Elliott, Johnston, LaClair, Manwani, Perez, Spencer, White |

Corporate Strategy/M&A

| • | •Whirlpool evaluates M&A opportunities to determine if there is a strategic fit, strong value creation potential, and clear execution capacity. Directors with strategy and M&A expertise provide critical insights in evaluating such opportunities. |

Directors with expertise: | | Allen, Bitzer, Creed, DiCamillo, Dietz, Johnston, LaClair, Liu, Loree, Manwani, Perez, Spencer, White |

Sales and Trade Management

| • �� | •A strong distribution strategy, maintaining excellent relationships, and delivering on our promises to trade customers are key drivers of our profitable growth, and such skills enable directors to provide effective oversight of this aspect of our business. |

Directors with expertise: | | Allen, Bitzer, Creed, DiCamillo, Dietz, Elliott, Loree, Manwani, Perez, Spencer, White |

Product Development

| • | •Product leadership is key to our growth and success, and directors with this expertise provide development strategy and process insights. |

Directors with expertise: | | Allen, Bitzer, Creed, DiCamillo, Dietz, Johnston, Loree, Manwani, Spencer, White |

Innovation, Technology and Engineering

| • | •Whirlpool is committed to industry-leading and consumer-relevant innovation, and directors with this experience provide unique perspectives on our innovation strategy and execution. |

Directors with expertise: | | Allen, Bitzer, DiCamillo, Dietz, Elliott, Johnston, Loree, Poppe, Spencer, White |

Global Supply Chain, Manufacturing, Logistics

| • | •Whirlpool is focused on maintaining the best cost structure in the industry, and directors with this experience provide oversight of our manufacturing and logistics strategies. |

Directors with expertise: | | Allen, Bitzer, DiCamillo, Dietz, Johnston, Loree, Manwani, Poppe, Spencer, White |

Marketing/Digital Marketing/Branded Consumer Products

| • | •Brand leadership and enhancing the consumer experience for our branded products are key Whirlpool strategies, and directors with this expertise provide valuable insights.

|

Directors with expertise: | | Bitzer, Creed, DiCamillo, Dietz, Elliott, Loree, Manwani, Perez, Poppe, Spencer, White |

Accounting, Finance and Capital Structure

| • | •Whirlpool conducts business throughout the world and engages in complex financial transactions in numerous countries and currencies, and such skills assist our directors in evaluating our capital structure and overseeing our financial reporting. |

Directors with expertise: | | Allen, Bitzer, DiCamillo, Dietz, Johnston, LaClair, Liu, Loree, Perez, Poppe, Spencer, White |

Board Practices of Other Major Corporations

| • | •Whirlpool believes that effective corporate governance is a key to achieving strong results, and that experience on other boards provides our directors with valuable insights on emerging trends and effective governance and oversight. |

Directors with expertise: | | Allen, Creed, DiCamillo, Dietz, Elliott, Johnston, Liu, Loree, Manwani, Perez, Spencer, White |

Legal/Regulatory and Government Affairs

| • | •Whirlpool regularly faces legal and regulatory issues around the world. Such experience aids directors in overseeing Whirlpool'sour risk management and compliance in these constantly evolving areas. |

Directors with expertise: Dietz, LaClair, Loree, Poppe, Spencer, White |

Human Resources and Development Practices

| | Allen, Dietz, Loree, Spencer, White |

Human Resources and Development Practices | • | Thoughtful succession planning and talent management are key to ensuring our continued success, and directors with HR and development expertise are adept at assessing our talent pipeline. |

Directors with expertise: | | Allen, Bitzer, Creed, Dietz, Johnston, LaClair, Loree, Manwani, Perez, Poppe, Spencer, White |

6lNotice of Annual Meeting of Stockholders and 2019 | | | | |

| Notice of Annual Meeting of Stockholders and 2020 Proxy Statement | |  ç ç | | 1 |

| | | | |

| | |

| | Item 1- Election of Directors ITEM 1 - ELECTION OF DIRECTORS |

| | Director Nominees |

We currently have 1314 directors on the Board. Directors who are elected will serve until our next annual meeting of stockholders and stand forre-election annually. Each of the nominees below has consented to be a nominee named in this proxy statement and to serve if elected. Messrs. Johnston and Perez will not be standing forre-election at the annual meeting of stockholders. The Board recommends a vote

FOR the election of each of the directors nominateddirector nominees below. |

| |

|

SAMUEL R. ALLEN |

| | Mr. Allen, 65,66, has served as a director since 2010. Mr. Allen has beenserves as Chairman and Chief Executive Officer of the Board of

Deere & Co., a farm machinery and equipment company, a position he has held since 2010, and a director since 2009. February 2010.

Mr. Allen will retire from the Deere & Co. Board effective May 1, 2020. He previously served in the

additional role of Chief Executive Officer, which he held from 2009 until November 2019. Mr. Allen

joined Deere & Co. in 1975 and since that time has held positions of increasing responsibility. |

Mr. Allenalso has served as a director of Dow Inc. since August 2019.•Committees:Corporate Governance and Nominating (chair);, Human Resources |

| | |

| |

MARC R. BITZER |

| | Mr. Bitzer, 54,55, has served as Chairman of the Board of Whirlpool Corporation since January 2019 and a

director since 2015. Mr. Bitzer was namedhas been President and Chief Executive Officer of Whirlpool Corporation in October

since 2017. He previously served as President and Chief Operating Officer of Whirlpool Corporation from 2015 to

2017. Prior to this role, Mr. Bitzer was Vice Chairman, Whirlpool Corporation, a position he held from

2014 to 2015. Prior to this role, Mr. Bitzer washad been President of Whirlpool North America and Whirlpool Europe, Middle

East, and Africa after holding other positions of increasing responsibility since 1999. |

| | |

|

GREG CREED |

| |

GREG CREED |

| Mr. Creed, 61,62, has served as a director since 2017. Mr. Creed has beenserved as Chief Executive Officer of Yum!

Brands, Inc., a leading operator of quick service restaurants, since 2015.from 2015 until his retirement on

December 31, 2019. He served as Chief Executive Officer of Taco Bell Division from 2011 to 2014, and

as President and Chief Concept Officer of Taco Bell U.S. from 2007 to 2011 after holding other

positions of increasing responsibility with the company since 1994. Mr. Creed has served as a director

of Aramark since January 2020 and Yum! since 2014 and previously2014. Mr. Creed also served as a director of

International Game Technology from 2010 to 2015. •Committees:Human Resources, Finance |

| | |

• Committees: Human Resources; Finance

|

| |

GARY T. DICAMILLO |

| | Mr. DiCamillo, 68,69, has served as a director since 1997. Mr. DiCamillo has served as President and Chief Executive Officer of Universal Trailer Corporation since June 2017. He has been a Partner at Eaglepoint Advisors,

LLC, a turnaround, restructuring, and strategic advisory firm, since 2010. He also served as President

and Chief Executive Officer of Universal Trailer Corporation from June 2017 to January 2020. Prior to

joining Eaglepoint Advisors, LLC, Mr. DiCamillo was President and Chief Executive Officer of Advantage

Resourcing, a professional and commercial staffing company, from 2002 until August 2009. From

1995 to 2002, Mr. DiCamillo served as Chairman and Chief Executive Officer of Polaroid Corporation.

Mr. DiCamillo is a director of Purple Innovation, Inc. (formerly known as Global Partner Acquisition

Corp.) since 2015 and Universal Trailer Corporation since 2011. He previously served as a director of

Pella Corporation (fromfrom 1993 to 2007 and 2010 to 2018),2018; the Sheridan Group, Inc. (fromfrom 1989 to 2017), 2017;

and as a director, as well as Lead Director, of 3Com Corporation (fromfrom 2000 to 2009).2009. •Committees:Audit, Finance |

| | | | |

• Committees: Audit; Finance

2 |

| | ç | | Notice of Annual Meeting of Stockholders and 2020 Proxy Statement |

Notice of Annual Meeting of Stockholders and 2019 Proxy Statement l 7

| | | | |

| | |

| | Item 1- Election of Directors ITEM 1 - ELECTION OF DIRECTORS |

| | Director Nominees |

|

| |

|

DIANE M. DIETZ |

| | Ms. Dietz, 53,54, has served as a director since 2013. Ms. Dietz has been the President and Chief

Executive Officer of Rodan & Fields, LLC, a leading premium skincare company, since 2016. Ms. Dietz

served as Executive Vice President and Chief Marketing Officer of Safeway, Inc., a leading food and

drug retailer, from 2008 to 2015. Prior to joining Safeway, Inc., Ms. Dietz held positions of increasing

responsibility with The Procter & Gamble Company from 1989 through 2008. |

•Committees:Corporate Governance and Nominating;Nominating, Human Resources |

| | |

| |

GERRI T. ELLIOTT |

| | Ms. Elliott, 62,63, has served as a director since 2014. Ms. Elliott has served as the Executive Vice

President and Chief Sales and Marketing Officer of Cisco Systems, Inc. since April 2018. Ms. Elliott

previously served as the Executive Vice President, Strategic Advisor and Chief Customer Officer of

Juniper Networks, a producer of high-performance networking equipment, from 2013 to 2014.

Ms. Elliott began her employment with Juniper Networks in 2009 and held positions of increasing

responsibility with the company through 2014. Before joining Juniper Networks, Ms. Elliott washeld

positions of increasing responsibility at Microsoft Corporation where she was Corporate Vice President, Worldwide Public Sector Organization from 2004 to 2008. Prior to joining Microsoft Corporation,and IBM Corporation. Ms. Elliott spent 22 years at IBM Corporation, where she held several senior executive positions in the U.S. and internationally. Ms. Elliott was

previously a director of Bed Bath & Beyond, Inc. (2014from 2014 to 2017),2017; Imperva, Inc. (2015from 2015 to 2018), 2018;

Marvell Technology Group Ltd. (2017from 2017 to 2018),2018; and Mimecast Limited (2017from 2017 to 2018).2018. •Committees:Audit,Finance |

| | |

• Committees: Audit;Finance

|

| JENNIFER A. LACLAIR |

| |

MICHAEL F. JOHNSTON |

| Mr. Johnston, 71,Ms. LaClair, 48, has served as Chief Financial Officer of Ally Financial Inc., a directorleading financial services

provider, since 2003. Mr. Johnston retired from Visteon Corporation, an automotive components supplier,joining the company in 2008. At Visteon, heMarch 2018. Prior to joining Ally, Ms. LaClair spent 10 years at

PNC Financial Services, where she held positions of increasing responsibility, most recently as leader

of the company’s business bank. Before that, she served as Chairmanchief financial officer for all of thePNC’s lines

of business, including Retail Banking, Asset Management, Mortgage Banking, and Corporate &

Commercial Banking. Prior to joining PNC, Ms. LaClair was a consultant with McKinsey and Company.

Ms. LaClair was recommended to our Corporate Governance and Nominating Committee and Board and Chief Executive Officer, President, and Chief Operating Officer at various times since 2000. In May 2009, Visteon filed for voluntary reorganization under Chapter 11 of the U.S. Bankruptcy Code. Before joining Visteon, Mr. Johnston held various positions in the automotive and building services industry. Mr. Johnston is also by

a director of Armstrong Flooring, Inc. (since 2016) and Dover Corporation (since 2013), and previously served as a director of Armstrong World Industries, Inc. (2010 to 2016), and Flowserve Corporation (1997 to 2013).third party search firm. • Director Nominee |

| | |

• Committees: Audit; Human Resources (chair)

|

| |

JOHN D. LIU |

| | Mr. Liu, 50,51, has served as a director since 2010. Mr. Liu has been the Chief Executive Officer of Essex

Equity Management, a financial services company, and Managing Partner of Richmond Hill

Investments, an investment management firm, since 2008. Prior to that time, Mr. Liu was employed for

12 years by Greenhill & Co. Inc., a global investment banking firm, in positions of increasing

responsibility including Chief Financial Officer. Mr. Liu has served as a director of Greenhill & Co. since 2017. •Committees:Audit, Finance |

| | | | |

Notice of Annual Meeting of Stockholders and 2020 Proxy Statement | |  • Committees:ç Audit; Finance | | 3 |

8lNotice of Annual Meeting of Stockholders and 2019 Proxy Statement

| | | | |

| | |

| | Item 1- Election of Directors ITEM 1 - ELECTION OF DIRECTORS |

| | Director Nominees |

|

| |

|

JAMES M. LOREE |

| | Mr. Loree, 60,61, has served as a director since 2017. Mr. Loree has been President and Chief Executive

Officer of Stanley Black & Decker, Inc., a leading industrial and consumer products company, since

2016. Prior to this, heMr. Loree served as President and Chief Operating Officer of the company from 2013 to 2016, 2016;

Chief Operating Officer from 2009 to 2013,2013; Executive Vice President and Chief Financial Officer from

2002 to 2009,2009; and Vice President and Chief Financial Officer from 1999 to 2002. Prior to joining Stanley

Black & Decker, Mr. Loree held positions of increasing responsibility in financial and operating

management in business, corporate, and financial services at General Electric from 1980 to 1999.

Mr. Loree has served as a director of Stanley Black & Decker since 2016, and previously served on the

board of Harsco Corporation from 2010 to 2016 and as chairman of Harsco'sHarsco’s Audit Committee from

2012 to 2016. |

• Committees: Audit;Committees:Audit, Corporate Governance and Nominating |

| | |

|

HARISH MANWANI |

| |

HARISH MANWANI |

| Mr. Manwani, 65,66, has served as a director since 2011. Mr. Manwani is a Senior Operating Partner for

Blackstone Group, having served with Blackstone since 2015. Mr. Manwani is the former Chief

Operating Officer of Unilever, a global consumer product brands company, a position he was appointed to in held from

2011 and held until his retirement in 2014. Mr. Manwani is also a director of Gilead Sciences, Inc. (since May 2018), since 2018,

Qualcomm Inc. (since 2014)since 2014, and Nielsen Holdings plc (since 2015).since 2015. Mr. Manwani previously served as the

non-executive Chairman of Hindustan Unilever Limited (2005from 2005 to 2018)2018 and as a director of Pearson

plc (2013from 2013 to 2018). |

2018.• Committees: Committees:Corporate Governance and Nominating;Nominating, Human Resources |

| | |

|

PATRICIA K. POPPE |

| |

WILLIAM D. PEREZ |

| Mr. Perez, 71,Ms. Poppe, 51, has served as a director since 2009. Mr. Perez was a Senior Advisor to Greenhill & Co., Inc., a global investment banking firm, from 2010 to 2017. Prior to joining Greenhill & Co., Inc., Mr. Perez wasDecember 2019. Ms. Poppe has been President and

Chief Executive Officer of CMS Energy Corporation and its principal subsidiary, Consumers Energy

Company, Michigan’s largest utility and the Wm. Wrigley Jr. Company nation’s fourth largest combination utility, since 2016.

Ms. Poppe served as Senior Vice President of distribution operations, engineering, and transmission

from 20062015 to 2008,2016, after holding positions of increasing responsibility since joining the company in

2011. Ms. Poppe held a variety of automotive management positions and President, Chief Executive Officer, and a served as power plant

director of Nike, Inc. from 2004 to 2006. Mr. Perez spent 34 years at S.C. JohnsonDetroit, Michigan-based DTE Energy before joining Consumers Energy in various positions, including Chief Executive Officer and President. Mr. Perez is also a director of Johnson & Johnson (since 2007) and Johnson Outdoors, Inc. (since December 2018), and previously2011. Ms. Poppe

has served as a director of Kellogg Company (2000CMS Energy and Consumers Energy since 2016. Ms. Poppe was

recommended to 2006)our Corporate Governance and Campbell Soup Company (2009 to 2012). |

Nominating Committee and Board by a third-partysearch firm.•Committees: Finance (chair); Human Resources |

| Audit, Corporate Governance and Nominating |

Notice of Annual Meeting of Stockholders and 2019 Proxy Statement l 9

|

| | |

|

LARRY O. SPENCER |

| | Item 1- Election of Directors |

| Director Nominees |

|

| |

LARRY O. SPENCER |

| General Spencer, 65,66, has served as a director since 2016. General Spencer serves as President of the

Armed Forces Benefit Association, a position he has held since March 2020. General Spencer served

until March 1, 2019 as President of the Air Force Association, a position he held since his retirement as a

four-star general in 2015 after serving 44 years with the United States Air Force. General Spencer held

positions of increasing responsibility with the Air Force, which included Vice Chief of Staff, the second

highest-ranking military member in the Air Force. General Spencer was the first Air Force officer to

serve as the Assistant Chief of Staff in the White House Military Office and he served as Chief Financial

Officer and then Director of Mission Support at a major command. General Spencer is also a director of

Triumph Group, Inc. (since 2018). |

since 2018 and Haynes International, Inc. since January 2020.•Committees:Corporate Governance and Nominating;Nominating, Finance |

| | | | |

| 4 | | ç | | Notice of Annual Meeting of Stockholders and 2020 Proxy Statement |

| | | | |

| | |

| | ITEM 1 - ELECTION OF DIRECTORS | | |

| | |

|

MICHAEL D. WHITE |

| | Mr. White, 67,68, has served as a director since 2004. Mr. White served as an Advisory Partner for Trian Fund Management, L.P. from 2016 to 2017, and was the Chairman, President and

Chief Executive Officer of DIRECTV, a leading provider of digital television entertainment services, from

2010 until his retirement in 2015. He also served as a director of the companyDIRECTV from 2009 until 2015. From

2003 until 2009, Mr. White was Chief Executive Officer of PepsiCo International, and Vice Chairman,

PepsiCo, Inc. after holding positions of increasing responsibility with PepsiCo since 1990. Mr. White is

also a director of Kimberly-Clark Corporation (since 2015)since 2015 and Bank of America Corporation (since 2016). |

since 2016.• Committees: Committees:Audit (chair);, Corporate Governance and Nominating |

|

|

The Board of Directors recommends that stockholders vote FOR the election of each of these nominees as a director. |

The following directors are not standing for re-election

| | |

|

MICHAEL F. JOHNSTON |

| | Mr. Johnston, 72, has served as a director since 2003. Mr. Johnston retired from Visteon Corporation,

an automotive components supplier, in 2008. At Visteon, he served as Chairman of the Board and Chief

Executive Officer, President, and Chief Operating Officer at various times since 2000. Before joining

Visteon, Mr. Johnston held various positions in the automotive and building services industry.

Mr. Johnston is also a director of Armstrong Flooring, Inc. since 2016 and Dover Corporation since

2013, and previously served as a director of Armstrong World Industries, Inc. from 2010 to 2016, and

Flowserve Corporation from 1997 to 2013. •Committees:Audit; Human Resources (chair) |

| | |

|

WILLIAM D. PEREZ |

| | Mr. Perez, 72, has served as a director since 2009. Mr. Perez was a Senior Advisor to Greenhill & Co.,

Inc., a global investment banking firm, from 2010 to 2017. Prior to joining Greenhill, Mr. Perez was

President and Chief Executive Officer of the Wm. Wrigley Jr. Company from 2006 to 2008, and

President, Chief Executive Officer, and a director of Nike, Inc. from 2004 to 2006. Mr. Perez spent 34

years at S.C. Johnson in various positions, including Chief Executive Officer and President. Mr. Perez is

also a director of Johnson & Johnson since 2007 and Johnson Outdoors, Inc. since December 2018,

and previously served as a director of Kellogg Company from 2000 to 2006 and Campbell Soup

Company from 2009 to 2012. •Committees:Finance (chair), Human Resources |

| | | | |

| Notice of Annual Meeting of Stockholders and 2020 Proxy Statement | |  ç ç | | 5 |

10lNotice of Annual Meeting of Stockholders and 2019 Proxy Statement

| | | | |

| | |

| | BOARD OF DIRECTORS AND CORPORATE GOVERNANCE |

| | Board of Directors and Corporate Governance |

Board of Directors and Corporate Governance

|

|

I. Board of Directors and Committees |

During 2018,2019, our Board met sevensix times and had four committees. The committees consisted of an Audit Committee, a Corporate Governance and Nominating Committee, a Human Resources Committee, and a Finance Committee. Each committee may form subcommittees and delegate certain actions to those subcommittees. Each director attended at least 75% of the total number of meetings of the Board and the Board committees on which he or she served.

All directors properly nominated for election are expected to attend the annual meeting of stockholders. In 2018,2019, all of our directors attended the annual meeting of stockholders.

Each committee may form subcommittees and delegate certain actions to those subcommittees.

meeting.The table below lists the number of times each committee met in 2018,2019, the major responsibilities and 2019 accomplishments of each committee, and the current membership for each committee.

|

| | |

| |

Committee | | Key Responsibilities and Accomplishments |

| Audit | •

| •Oversee accounting functions, internal controls, and the integrity of financial statements and related reports |

| Oversee compliance with legal and regulatory requirements, and monitor risk management and assessment processes |

| Retain the independent registered public accounting firm; monitor the firm'sfirm’s performance, qualifications, and independence; and approve all fees |

8 meetings |

| Oversee the performance of our internal audit function |

Committee Members:8 meetings | | • In 2019, oversaw selection of new lead audit partner and Embraco sale accounting |

Committee Members: | | White (Chair), DiCamillo, Elliott, Johnston, Liu, Loree, and LoreePoppe |

| •

| •Identify potential Board members and recommend director nominees |

| Annually review Board and committee effectiveness |

| Recommend changes to director compensation and committee rotation |

3 meetings |

| Recommend the corporate governance principles adopted by Whirlpool |

Committee members:3 meetings | | • In 2019, evaluated and recommended Patricia K. Poppe as new director to Board |

Committee members: | | Allen (Chair), Dietz, Loree, Manwani, Poppe, Spencer, and White |

| Human Resources | •

| •Determine and approve compensation for CEO and other executive officers |

| Approve goals/objectives for CEO compensation and evaluate CEO performance |

| Determine and approve equity grants for executive officers and each employee subject to Section 16 of the Securities Exchange Act of 1934 |

5 meetings |

| Make recommendations to the Board on Whirlpool'sCompany incentive plans |

Committee members:3 meetings | | • For 2019, oversaw the development of new long-term incentive plan structure |

Committee members: | | Johnston (Chair), Allen, Creed, Dietz, Manwani, and Perez |

| Finance | •

| •Review capital policies and strategies to set an acceptable capital structure, including debt issuance and share repurchases |

| Review policies regarding dividends, derivatives, liquidity management, interest rates, and foreign exchange rates |

| Reviewtax-planning strategy and initiatives |

2 meetings |

| Oversee the establishment and implementation of guidelines relating to the management of significant financial structure risks |

Committee members:2 meetings | | • For 2019, oversaw actions facilitating corporate deleveraging goals |

Committee members: | | Perez (Chair), Creed, DiCamillo, Elliott, Liu, and Spencer |

| | | | |

| 6 | | ç | | Notice of Annual Meeting of Stockholders and 2020 Proxy Statement |

Notice of Annual Meeting of Stockholders and 2019 Proxy Statement l 11

| | | | |

| | |

| | BOARD OF DIRECTORS AND CORPORATE GOVERNANCE | | |

| Board of Directors and Corporate Governance |

The Corporate Governance and Nominating Committee conducts an annual review of the independence of the members of the Board and its committees, and reports its findings to the full Board. TwelveThirteen of our 1314 directors arenon-employee directors (all except Mr. Bitzer). Our new director nominee, Ms. LaClair, also has no employment relationship with Whirlpool. The Board has adopted the NYSENew York Stock Exchange (“NYSE”) listing standards for evaluating director independence, but has not adopted any other categorical standards of materiality for independence purposes. When assessing director independence, the Board considers the various transactions and relationships known to the Board (including those identified through annual director questionnaires) that exist between the CompanyWhirlpool and the entities with which our directors or members of their immediate families are, or have been, affiliated. For 2018,2019, the Committee evaluated certain transactions that arose in the ordinary course of business between the CompanyWhirlpool Corporation and such entities and which did not exceed the thresholds provided under the NYSE listing standards. Information provided by the directors, new director nominee, and Whirlpool did not indicate any relationships (e.g., commercial, industrial, banking, consulting, legal, accounting, charitable, or familial) whichthat would impair the independence of any of thenon-employee directors. directors or new director nominee. Based on the report and recommendation of the Corporate Governance and Nominating Committee, the Board has determined that each of its non‑employeenon-employee directors satisfiesand new director nominee satisfy the independence standards set forth in the listing standards of the NYSE.

Committee Member Independence and Expertise

Each Board committee is comprised solely of independent directors who meet the independence standards under the NYSE listing standards.

In addition, the Audit Committee members all meet the enhanced independence standards for audit committee members set forth in the NYSE listing standards (which incorporates the standards set forth in the rules of the Securities and Exchange Commission)Commission (“SEC”)). The Board has determined that each member of the Audit Committee satisfies the financial literacy qualifications of the NYSE listing standards, and that Mr. White, satisfies the "auditAudit Committee Chair, and Mr. DiCamillo, the prior Audit Committee Chair, qualify under the “audit committee financial expert"expert” criteria established by the SecuritiesSEC and Exchange Commission and hashave accounting and financial management expertise as required under the NYSE listing rules.

Similarly, the Human Resources Committee members all meet the enhanced independence standards for compensation committee members under the NYSE listing standards (which incorporates the standards set forth in the rules of the Securities and Exchange Commission)SEC), and qualify as "outside directors"“outside directors” for purposes of compensation intended to be grandfathered under Section 162(m) of the Internal Revenue Code, and as "non-employee directors"“non-employee directors” for purposes of Rule16b-3 under the Securities Exchange Act of 1934. For information about the Human Resources Committee'sCommittee’s processes for establishing and overseeing executive compensation, refer to "Compensation“Compensation Discussion and Analysis – Role of the Human Resources Committee."

Board Leadership Structure

As noted above, our Board is currently comprised of twelvethirteen independent directors and one employee director. Mr. Fettig, our Chief Executive Officer until October 2017, served as Chairman of the Board from July 2004 to December 31, 2018. In October 2017, Mr. Bitzer became the Chief Executive Officer of the Company.

The Board regularly evaluates our boardBoard leadership structure to ensure that it serves the interests of our stockholders. In connection with Mr. Fettig's retirement as Executive Chairman, the Board assessed its leadership structure. After review and discussion, the Board concluded that the critical oversight provided by independent directors and a strong independent Presiding Director, combined with the organizational leadership

12lNotice of Annual Meeting of Stockholders and 2019 Proxy Statement

|

| | |

| | |

| Board of Directors and Corporate Governance |

of a unified Chairman and Chief Executive Officer role, would best serve the interests of the Company and its stockholders. On January 1, 2019, Mr. Bitzer became Chairman of the Board.

We recognize that different Board leadership structures may be appropriate for companies in different situations and believe that no one structure is suitable for all companies. The Board of Directors believes that the Board leadership structure, with a unified Chairman and CEO and independent Presiding Director, is optimal for Whirlpool because it demonstrates to our employees, suppliers, customers, and other stakeholders that Whirlpool is under strong leadership, with a single person setting the tone and having primary responsibility for managing our operations. Having a single leader for both

the CompanyWhirlpool and the Board eliminates the potential for confusion or duplication of efforts, and provides clear leadership for Whirlpool. In addition, Mr.

Bitzer'sBitzer’s unique expertise and experience, having served Whirlpool for 20 years in positions of increasing responsibility

around the world,globally, contributes significantly to how the Board guides

the Company'sour strategy.

| | | | |

| Notice of Annual Meeting of Stockholders and 2020 Proxy Statement | |  ç ç | | 7 |

| | | | |

| | |

| | BOARD OF DIRECTORS AND CORPORATE GOVERNANCE | | |

Since 2003, the Board has designated one of the independent directors as Presiding Director. We believe that the number of independent, experienced directors that make up our Board, along with the independent oversight of our Presiding Director, benefits Whirlpool and its stockholders. Mr. Allen is currently serving as the Presiding Director.

|

| | | | | | |

| | | |

| Presiding Director Responsibilities | | |

| | Presiding Director Responsibilities• Preside at executive sessions ofnon-employee directors; | | |

| | • | Preside at executive sessions of non-employee directors; | |

| | • | Coordinate with the Chairman of the Board and Chief Executive Officer in establishing the annual agenda and topic items for Board meetings; | | |

| | • | Serve as a focal point for managing stockholder communication with independent directors; | | |

| | • | Retain independent advisors on behalf of the Board as the Board may determine is necessary or appropriate; | | |

| | • | Assist the Human Resources Committee with the annual evaluation of the performance of the Chairman of the Board and Chief Executive Officer;Officer, and in conjunction with the Chair of the Human Resources Committee, meet with the Chairman of the Board and Chief Executive Officer to discuss the results of such evaluation; and | | |

| | • | Perform such other functions as the independent directors may designate from time to time. | |

| | | | |

| | | | | | |

Our Board conducts an annual evaluation in order to determine whether it and its committees are functioning effectively. As part of this annual self evaluation,self-evaluation, the Board evaluates whether the current leadership structure continues to be optimal for Whirlpool and its stockholders. Our Corporate Governance Guidelines provide the flexibility for our Board to modify or continue our leadership structure in the future, as it deems appropriate.

Strategy Oversight

Our Board is actively involved in overseeing, reviewing, and guiding our corporate strategy, and the Board’s skills and experiences align to our strategic objectives. The Board formally reviews strategy, including risks and opportunities facing Whirlpool, at an annual strategic planning meeting. In addition, long-range strategic issues, including business performance and strategic fit, are discussed regularly at Board meetings. The Board regularly discusses strategy throughout the year with management and during executive sessions of the Board, as appropriate.

Risk Oversight

Our Board is responsible for overseeing Whirlpool's risk management. The Board focuses on Whirlpool'sour general risk management strategy and the most significant risks facing Whirlpool, including cybersecurity risk, and ensures that appropriate risk mitigation policies and procedures are implemented by management. The Board receives risk management updates from management in connection with its general oversight and approval of corporate matters.

The Board has delegated to the Audit Committee oversight of Whirlpool'sour risk management process. Among its duties, the Audit Committee reviews with management:

Whirlpool's policiesCompany guidelines with respect to risk assessment and management of risks that may be material to Whirlpool;

Notice of Annual Meeting of Stockholders and 2019 Proxy Statement l 13

|

| | |

| | |

| Board of Directors and Corporate Governance |

Whirlpool'sOur system of disclosure controls and system of internal controls over financial reporting;

Whirlpool'sOur compliance with legal and regulatory requirements; and

Major legislative and regulatorySituations where new activities, major changes in operations, or other developments that could materially impact Whirlpool's contingent liabilities and risks.may create financial risk.

Our other Board committees also consider and address risk as they perform their respective committee responsibilities. All committees report to the full Board as appropriate, including when a matter rises to the level of a material or enterprise level risk.

Our Board is responsible for overseeing and holding senior management accountable for our global information security programs. This includes understanding our business needs and associated risks, and reviewing management’s strategy and recommendations for managing cyber risk. In line with this oversight responsibility, the Audit Committee receives reports on cyber program effectiveness periodically, and the Board receives a full presentation annually from the chief information officer.

| | | | |

| 8 | | ç | | Notice of Annual Meeting of Stockholders and 2020 Proxy Statement |

Whirlpool's | | | | |

| | |

| | BOARD OF DIRECTORS AND CORPORATE GOVERNANCE | | |

Our management is responsible forday-to-day risk management. Our risk management, internal audit, and compliance areas serve as the primary monitoring and testing functions for Company-wide policies and procedures and manage theday-to-day oversight of the risk management strategy for the ongoing business of Whirlpool. This oversight includes identifying, evaluating, and addressing potential risks that may exist at the enterprise, strategic, operational, and compliance and financial reporting levels.

We believe the division of risk management responsibilities described above is an effective approach for addressing the risks facing Whirlpool, and that our Board leadership structure supports this approach.

Compensation Risk Assessment

Whirlpool regularly reviews its employee compensation programs based on several criteria, including the extent to which they may result in risk to the Company.Whirlpool. Our compensation function, with assistance from the risk management and internal audit functions, annually assesses whether our compensation programs create incentives or disincentives that materially affect risk taking or are reasonably likely to have a material adverse effect on the Company.Whirlpool. The Human Resources Committee, with the assistance of its independent compensation consultant, Frederic W. Cook & Co., Inc. ("(“FW Cook"Cook”), evaluates the results of this assessment. As part of this assessment, management and the Human Resources Committee considered the followingrisk-mitigating features of our compensation programs.

|

| | | | | | |

| | | |

| Risk-Mitigating Features of Whirlpool Corporation’s Compensation Programs | | |